It’s an obvious conclusion that insurance companies don’t want their customers to go rate shopping. People who shop around are very likely to move their business because there is a significant possibility of finding a policy with better rates. A recent auto insurance study revealed that consumers who shopped around saved an average of $865 a year compared to those who never compared other company’s rates.

It’s an obvious conclusion that insurance companies don’t want their customers to go rate shopping. People who shop around are very likely to move their business because there is a significant possibility of finding a policy with better rates. A recent auto insurance study revealed that consumers who shopped around saved an average of $865 a year compared to those who never compared other company’s rates.

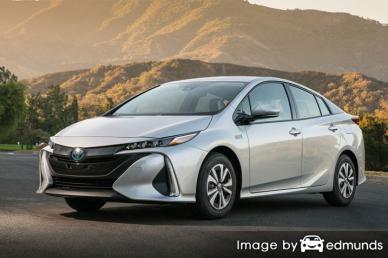

If finding the cheapest price on Toyota Prius Prime insurance in Portland is the reason you’re reading this, understanding how to get rate quotes and compare car insurance can make it easier to shop your coverage around.

Really, the only way to find discount car insurance rates in Portland is to start comparing prices regularly from companies who provide auto insurance in Oregon. Prices can be compared by following these steps.

- Try to comprehend how car insurance works and the things you can change to prevent expensive coverage. Many risk factors that are responsible for high rates such as speeding tickets, careless driving and an unacceptable credit rating can be amended by making minor changes to your lifestyle.

- Get rate quotes from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can only give prices from a single company like Progressive or Farmers Insurance, while independent agents can quote prices from many different companies. View prices

- Compare the price quotes to your current policy premium to determine if you can save on Prius Prime insurance in Portland. If you find a better price and buy the policy, make sure coverage is continuous and does not lapse.

- Tell your current agent or company to cancel your current policy and submit the signed application along with the required initial payment to your new company or agent. Once coverage is bound, keep the new certificate verifying coverage in an easily accessible location.

An important bit of advice to remember is that you use identical coverage information on every quote and and to get rate quotes from as many carriers as you can. This guarantees a level playing field and the best price selection.

If you have a current car insurance policy, you should be able to get lower rates using the ideas you’re about to read. Comparing rates for the most affordable car insurance policy in Portland is actually quite simple. Although Oregon car owners do need to know how companies charge you for coverage because it can help you find the best coverage.

Slash your auto insurance rates with these seven discounts

Auto insurance is expensive, but you may find discounts that can drop the cost substantially. Some trigger automatically when you purchase, but once in a while a discount must be specifically requested in order for you to get them. If you check and find you aren’t receiving every discount you deserve, you are just wasting money.

- Distant College Student Discount – Youth drivers who live away from home at college and leave their car at home may qualify for this discount.

- Theft Prevention System – Cars optioned with advanced anti-theft systems are less likely to be stolen and will save you 10% or more on Prius Prime insurance in Portland.

- Own a Home – Simply owning a home may earn you a small savings due to the fact that maintaining a home is proof of financial responsibility.

- Discount for Good Grades – Excelling in school can save 20 to 25%. Many companies even apply the discount to college students up to age 25.

- ABS and Traction Control Discounts – Vehicles with anti-lock braking systems have fewer accidents so companies give up to a 10% discount.

- Discount for Life Insurance – Select insurance companies reward you with a discount if you purchase some life insurance too.

- Organization Discounts – Participating in qualifying employment or professional organizations could earn you a nice discount when getting a Portland auto insurance quote.

Discounts save money, but please remember that some of the credits will not apply to the entire cost. Some only reduce specific coverage prices like liability and collision coverage. So despite the fact that it appears you can get free auto insurance, that’s just not realistic.

Popular auto insurance companies and some of the discounts include:

- GEICO policyholders can earn discounts including seat belt use, air bags, defensive driver, membership and employees, and anti-lock brakes.

- SAFECO offers discounts for anti-theft, bundle discounts, accident prevention training, multi-car, and teen safe driver.

- State Farm may include discounts for multiple autos, accident-free, passive restraint, good student, driver’s education, and multiple policy.

- MetLife includes discounts for accident-free, multi-policy, claim-free, good driver, and good student.

- 21st Century may offer discounts for teen driver, theft prevention, good student, air bags, and early bird.

- Progressive may have discounts that include online quote discount, continuous coverage, multi-vehicle, online signing, homeowner, and good student.

Double check with all the companies to give you their best rates. Some of the earlier mentioned discounts may not be offered in every state. If you would like to see a list of companies who offer cheap Toyota Prius Prime insurance quotes in Portland, click here.

Specific coverages for a Toyota Prius Prime

Understanding the coverages of auto insurance helps when choosing which coverages you need and proper limits and deductibles. The terms used in a policy can be ambiguous and reading a policy is terribly boring.

Medical expense insurance

Medical payments and Personal Injury Protection insurance pay for immediate expenses for things like chiropractic care, nursing services, surgery and rehabilitation expenses. The coverages can be used in conjunction with a health insurance policy or if you lack health insurance entirely. Medical payments and PIP cover all vehicle occupants and will also cover if you are hit as a while walking down the street. PIP is only offered in select states and gives slightly broader coverage than med pay

Protection from uninsured/underinsured drivers

This protects you and your vehicle’s occupants when other motorists do not carry enough liability coverage. This coverage pays for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Due to the fact that many Oregon drivers carry very low liability coverage limits (which is 25/50/20), their liability coverage can quickly be exhausted. This is the reason having UM/UIM coverage should not be overlooked. Most of the time these coverages are similar to your liability insurance amounts.

Comprehensive (Other than Collision)

Comprehensive insurance coverage will pay to fix damage from a wide range of events other than collision. You need to pay your deductible first and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage pays for claims such as fire damage, damage from a tornado or hurricane, hail damage and damage from flooding. The most a auto insurance company will pay at claim time is the actual cash value, so if the vehicle’s value is low consider removing comprehensive coverage.

Auto collision coverage

This pays for damage to your Prius Prime from colliding with an object or car. A deductible applies then your collision coverage will kick in.

Collision can pay for things such as damaging your car on a curb, sideswiping another vehicle and rolling your car. Collision is rather expensive coverage, so consider removing coverage from vehicles that are older. It’s also possible to choose a higher deductible on your Prius Prime to bring the cost down.

Auto liability insurance

Liability insurance protects you from damage that occurs to other people or property by causing an accident. Liability coverage has three limits: bodily injury per person, bodily injury per accident and property damage. You commonly see liability limits of 25/50/20 which means a $25,000 limit per person for injuries, a limit of $50,000 in injury protection per accident, and property damage coverage for $20,000. Occasionally you may see one limit called combined single limit (CSL) that pays claims from the same limit without having the split limit caps.

Liability coverage protects against things such as structural damage, pain and suffering and medical expenses. How much liability coverage do you need? That is up to you, but it’s cheap coverage so purchase higher limits if possible. Oregon requires drivers to carry at least 25/50/20 but you should consider buying more liability than the minimum.

The illustration below demonstrates why buying minimum limits may not provide adequate coverage.

Cheap auto insurance premiums are possible

Lower-priced Toyota Prius Prime insurance in Portland is definitely available from both online companies as well as from independent agents in Portland, and you need to comparison shop both to have the best chance of lowering rates. There are still a few companies who do not offer internet price quotes and many times these small, regional companies only sell coverage through independent agencies.

As you prepare to switch companies, do not skimp on critical coverages to save a buck or two. There are a lot of situations where an accident victim reduced full coverage and learned later that it was a big mistake. The goal is to buy the best coverage you can find at the best cost, not the least amount of coverage.

We just presented a lot of tips how to get a better price on Toyota Prius Prime insurance in Portland. The key thing to remember is the more rate comparisons you have, the better your chances of lowering your car insurance rates. Consumers may even find the biggest savings come from a company that doesn’t do a lot of advertising.

Additional information

- Collision Insurance Coverage (Nationwide)

- Who Has the Cheapest Auto Insurance for Government Employees in Portland? (FAQ)

- How Much is Auto Insurance for 17 Year Olds in Portland? (FAQ)

- Who Has Affordable Portland Car Insurance for Drivers with Good Credit? (FAQ)

- Auto Theft Statistics (Insurance Information Institute)

- Can I Drive Legally without Insurance? (Insurance Information Institute)

- New vehicle ratings focus on headlights (Insurance Institute for Highway Safety)