A recent auto insurance study discovered that almost 70% of insureds have been with the same company for well over three years, and virtually 40% of consumers have never compared quotes from other companies. Oregon drivers can save roughly 60% each year, but they don’t invest the time required to go online and compare rates.

A recent auto insurance study discovered that almost 70% of insureds have been with the same company for well over three years, and virtually 40% of consumers have never compared quotes from other companies. Oregon drivers can save roughly 60% each year, but they don’t invest the time required to go online and compare rates.

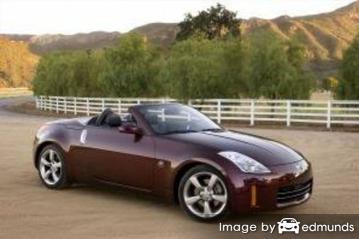

If you want to save the most money, the best way to find cheaper Nissan 350Z insurance in Portland is to regularly compare prices from insurance carriers who sell insurance in Oregon.

- Read and learn about how auto insurance works and the things you can control to prevent expensive coverage. Many risk factors that cause high rates like traffic tickets, fender benders, and bad credit can be rectified by making minor driving habit or lifestyle changes.

- Compare rates from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only give rate quotes from a single company like GEICO and State Farm, while agents who are independent can quote prices for many different companies. Begin your rate comparison

- Compare the new rate quotes to your existing rates to see if switching to a new carrier will save money. If you can save some money and switch companies, make sure coverage is continuous and does not lapse.

- Notify your company or agent of your intent to cancel your current auto insurance policy and submit the required down payment along with the signed application to the newly selected company. Immediately place the new certificate verifying coverage along with the vehicle’s registration papers.

An important note is to try to compare the same amount of coverage on each quote and and to get rates from as many companies as feasibly possible. This provides a fair price comparison and maximum price selection.

Affordable companies for Nissan 350Z insurance in Oregon

The car insurance companies shown below are ready to provide free quotes in Portland, OR. If you wish to find cheaper car insurance in Portland, OR, we suggest you click on several of them to get a more complete price comparison.

Take advantage of these ten discounts on Nissan 350Z insurance in Portland

Not many people think insurance is cheap, but you may find discounts to reduce the price significantly. Some trigger automatically at the time you complete a quote, but less common discounts must be manually applied before being credited.

- Policy Bundle Discount – If you can bundle your auto and homeowners insurance and place coverage with the same company you may earn nearly 15% which can help you find the cheapest Nissan 350Z insurance in Portland.

- Discounts for New Vehicles – Buying insurance on a new vehicle can get you a discount due to better safety requirements for new model year vehicles.

- Defensive Driver Discount – Taking part in a course in driver safety could earn you a small percentage discount if your company offers it.

- Low Mileage – Keeping the miles down on your Nissan may enable drivers to earn cheaper auto insurance rates.

- Onboard Data Collection – Drivers that enable their auto insurance company to look at driving manner by using a small device installed in their vehicle such as In-Drive from State Farm or Allstate’s Drivewise system might see lower rates if they exhibit good driving behavior.

- No Accidents – Claim-free drivers can save substantially compared to insureds who have frequent claims or accidents.

- Early Renewal Discounts – A few companies offer discounts for signing up early. This can save 10% or more.

- ABS Brakes – Cars and trucks that have steering control and anti-lock brakes can stop better under adverse conditions and therefore earn up to a 10% discount.

- Senior Citizen Rates – Drivers over the age of 55 can get a slight reduction on a Portland car insurance quote.

- Student in College – Youth drivers who are attending college and leave their car at home can receive lower rates.

A quick disclaimer, some of the credits will not apply to the entire cost. Most only reduce specific coverage prices like liability, collision or medical payments. Despite the fact that it seems like you can get free auto insurance, you won’t be that lucky.

A list of companies and the discounts they provide are shown below.

- State Farm may offer discounts for multiple autos, good student, multiple policy, driver’s education, student away at school, and safe vehicle.

- GEICO offers discounts for air bags, multi-vehicle, membership and employees, seat belt use, emergency military deployment, and good student.

- Allstate discounts include new car, multi-policy, 55 and retired, good payer, farm vehicle, and economy car.

- SAFECO may include discounts for anti-lock brakes, accident prevention training, drive less, homeowner, anti-theft, teen safety rewards, and teen safe driver.

- Farm Bureau offers discounts including renewal discount, safe driver, good student, 55 and retired, and youthful driver.

- Progressive may have discounts that include homeowner, multi-policy, multi-vehicle, good student, online signing, and continuous coverage.

- AAA includes discounts for good driver, AAA membership discount, multi-policy, anti-theft, education and occupation, and multi-car.

If you want cheaper Portland car insurance quotes, ask every insurance company which credits you are entitled to. Some of the earlier mentioned discounts may not apply to policies in every state. If you would like to view companies with significant discounts in Oregon, click here.

Buying insurance from Portland insurance agencies

A small number of people prefer to buy from a licensed agent and often times that is recommended A good thing about comparing rates online is the fact that drivers can get the best rates but still work with a licensed agent. Buying from small agencies is especially important in Portland.

To make it easy to find an agent, after completing this short form, your insurance data is instantly submitted to agents in your area who will return price quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to even leave your home because prices are sent straight to your inbox. You can most likely find cheaper rates AND an agent nearby. If you want to get a comparison quote from one company in particular, don’t hesitate to navigate to their website and give them your coverage information.

To make it easy to find an agent, after completing this short form, your insurance data is instantly submitted to agents in your area who will return price quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to even leave your home because prices are sent straight to your inbox. You can most likely find cheaper rates AND an agent nearby. If you want to get a comparison quote from one company in particular, don’t hesitate to navigate to their website and give them your coverage information.

Two types of car insurance agents

If you would like to find a reliable insurance agency, you must know there are a couple types of insurance agents and how they differ in how they quote coverages. Insurance agents in Portland can be described as either exclusive or independent (non-exclusive).

Independent Agents (or Brokers)

Agents of this type are not employed by any specific company and that enables them to quote your coverage through many companies and get you the best rates possible. To move your coverage to a new company, your agent can just switch to a different company and you don’t have to switch agencies.

When comparing insurance rates, it’s recommended you check rates from at least one independent agent for the best price selection.

The following is a partial list of independent agents in Portland who may be able to give you comparison quotes.

Pibal Insurance Brokers of Oregon

1314 NW Irving St – Portland, OR 97209 – (503) 287-8808 – View Map

Nationwide Insurance: Eric L Weber Agency

4415 NE Sandy Blvd Ste 200 – Portland, OR 97213 – (503) 249-7667 – View Map

Propel Insurance

888 SW 5th Ave #1170 – Portland, OR 97204 – (503) 467-7540 – View Map

Exclusive Insurance Agents

These agents normally can only provide a single company’s rates and examples are Allstate, State Farm and Farmers Insurance. Exclusive agencies are unable to give you multiple price quotes so it’s a take it or leave it situation. These agents are very knowledgeable in insurance sales which helps them compete with independent agents.

Below is a short list of exclusive agencies in Portland willing to provide price quote information.

Reggie Guyton – State Farm Insurance Agent

8180 N Lombard St – Portland, OR 97203 – (503) 289-3601 – View Map

Donna Tallman – State Farm Insurance Agent

6305 SE Powell Blvd – Portland, OR 97206 – (503) 771-2579 – View Map

Mark Nguyen – State Farm Insurance Agent

14146 SE Stark St – Portland, OR 97233 – (503) 253-2110 – View Map

Picking the best auto insurance agent should depend on more than just a cheap price. Get answers to these questions too.

- How much experience to they have in personal lines coverages?

- Are they able to influence company decisions when a claim is filed?

- Can you use your own choice of collision repair facility?

- Which insurance companies are they affiliated with?

- Which members of your family are coverage by the policy?

- Is their price quote a firm figure or are their hidden costs?

- Are they properly licensed to sell insurance in Oregon?

- What kind of financial rating does the company have?

How to find a good Oregon car insurance company

Insuring your vehicle with a good quality car insurance provider is difficult considering how many different insurance companies sell coverage in Oregon. The ranking information listed below may help you select which companies you want to consider comparing rates with.

Top 10 Portland Car Insurance Companies Overall

- USAA

- American Family

- State Farm

- The Hartford

- AAA Insurance

- GEICO

- The General

- Titan Insurance

- Progressive

- Mercury Insurance

Top 10 Portland Car Insurance Companies Ranked by Claims Service

- State Farm

- Esurance

- AAA Insurance

- Progressive

- Liberty Mutual

- GEICO

- Allstate

- Titan Insurance

- The Hartford

- Mercury Insurance

Auto insurance coverage breakdown

Having a good grasp of your policy aids in choosing appropriate coverage at the best deductibles and correct limits. Policy terminology can be impossible to understand and coverage can change by endorsement. Below you’ll find the normal coverages found on most auto insurance policies.

Comprehensive protection – Comprehensive insurance will pay to fix damage OTHER than collision with another vehicle or object. You first must pay your deductible then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage protects against claims such as damage from a tornado or hurricane, damage from flooding, rock chips in glass, fire damage and damage from getting keyed. The highest amount you’ll receive from a claim is the market value of your vehicle, so if the vehicle’s value is low it’s not worth carrying full coverage.

Liability insurance – Liability insurance provides protection from damage that occurs to other people or property that is your fault. This coverage protects you from claims by other people, and does not provide coverage for damage to your own property or vehicle.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. Your policy might show values of 25/50/20 which stand for $25,000 in coverage for each person’s injuries, a per accident bodily injury limit of $50,000, and $20,000 of coverage for damaged property. Alternatively, you may have a combined single limit or CSL which combines the three limits into one amount rather than limiting it on a per person basis.

Liability coverage pays for claims like pain and suffering, court costs, emergency aid and repair bills for other people’s vehicles. How much liability should you purchase? That is a decision to put some thought into, but consider buying higher limits if possible. Oregon state law requires minimum liability limits of 25/50/20 but drivers should carry more liability than the minimum.

The illustration below shows why low liability limits may not be high enough to cover claims.

Medical expense coverage – Med pay and PIP coverage pay for bills for things like nursing services, pain medications and EMT expenses. They are used to cover expenses not covered by your health insurance policy or if there is no health insurance coverage. They cover you and your occupants as well as being hit by a car walking across the street. Personal injury protection coverage is not an option in every state and may carry a deductible

Uninsured or underinsured coverage – This coverage protects you and your vehicle’s occupants when the “other guys” do not carry enough liability coverage. Covered losses include medical payments for you and your occupants as well as damage to your Nissan 350Z.

Due to the fact that many Oregon drivers only carry the minimum required liability limits (which is 25/50/20), their limits can quickly be used up. That’s why carrying high Uninsured/Underinsured Motorist coverage is important protection for you and your family. Normally these coverages do not exceed the liability coverage limits.

Collision coverage – This coverage pays for damage to your 350Z from colliding with an object or car. You have to pay a deductible then the remaining damage will be paid by your insurance company.

Collision insurance covers things such as crashing into a ditch, colliding with another moving vehicle and damaging your car on a curb. This coverage can be expensive, so analyze the benefit of dropping coverage from vehicles that are older. It’s also possible to bump up the deductible on your 350Z to save money on collision insurance.

Affordable insurance rates are possible

We just presented quite a bit of information on how to compare Nissan 350Z insurance prices in Portland. The key concept to understand is the more you quote Portland car insurance, the better chance you’ll have of finding affordable Portland car insurance quotes. You may even find the best prices are with some of the smallest insurance companies. These companies can often insure niche markets at a lower cost than their larger competitors like State Farm, GEICO and Nationwide.

Affordable Nissan 350Z insurance in Portland is possible both online in addition to many Portland insurance agents, so you need to shop Portland car insurance with both so you have a total pricing picture. Some insurance companies don’t offer online rate quotes and many times these small, regional companies prefer to sell through local independent agencies.

To read more, link through to these articles:

- Understanding your Policy (NAIC.org)

- Honda warning system reduces insurance claims (Insurance Institute for Highway Safety)

- Neck Injury FAQ (iihs.org)

- Credit and Insurance Scores (Insurance Information Institute)

- Bodily Injury Coverage (Liberty Mutual)