It’s an obvious assumption that auto insurance companies don’t want you comparing rates. People who shop around for the cheapest rate are highly likely to buy a new policy because there is a high probability of finding coverage at a more affordable price. A recent survey discovered that people who faithfully checked for cheaper rates saved about $72 a month compared to those who don’t make a habit of comparing rates.

If finding budget-friendly rates on car insurance in Portland is your ultimate target, then having an understanding of the best ways to shop for coverages can help make the process easier and more efficient.

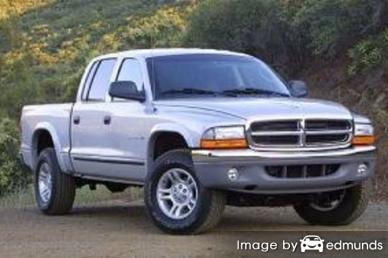

The preferred way to save money on Dodge Dakota insurance is to start comparing prices yearly from insurers who provide car insurance in Portland.

The preferred way to save money on Dodge Dakota insurance is to start comparing prices yearly from insurers who provide car insurance in Portland.

- Step 1: Try to comprehend car insurance and the things you can control to prevent expensive coverage. Many policy risk factors that are responsible for high rates such as inattentive driving and a lousy credit rating can be improved by being financially responsible and driving safely.

- Step 2: Request rate estimates from direct carriers, independent agents, and exclusive agents. Exclusive and direct companies can provide rates from one company like Progressive and State Farm, while independent agents can provide rate quotes for a wide range of companies.

- Step 3: Compare the new rate quotes to your existing rates and determine if there is any savings. If you find a lower rate quote and switch companies, ensure coverage does not lapse between policies.

- Step 4: Give proper notification to your current agent or company of your intention to cancel your current car insurance policy and submit payment and a signed application to your new insurance company. As soon as coverage is bound, keep the new certificate of insurance with your registration paperwork.

One thing to remember is to make sure you enter the same amount of coverage on every quote request and and to get price quotes from as many carriers as you can. Doing this provides a level playing field and a better comparison of the market.

Companies offering competitive Dodge Dakota rates in Portland, OR

The companies shown below offer free quotes in Portland, OR. If you want to find cheap auto insurance in Portland, we suggest you visit two to three different companies to find the lowest auto insurance rates.

Analysis of coverages

The table displayed next showcases estimates of insurance coverage prices for Dodge Dakota models. Having knowledge of how policy premiums are figured can assist in making decisions when shopping around.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Dakota ST Ext Cab 2WD | $130 | $300 | $484 | $28 | $144 | $1,086 | $91 |

| Dakota Bighorn Ext Cab 2WD | $130 | $300 | $484 | $28 | $144 | $1,086 | $91 |

| Dakota Lonestar Ext Cab 2WD | $150 | $300 | $484 | $28 | $144 | $1,106 | $92 |

| Dakota ST Crew Cab 2WD | $150 | $300 | $484 | $28 | $144 | $1,106 | $92 |

| Dakota Bighorn Crew Cab 2WD | $150 | $354 | $484 | $28 | $144 | $1,160 | $97 |

| Dakota Lonestar Crew Cab 2WD | $150 | $354 | $484 | $28 | $144 | $1,160 | $97 |

| Dakota Bighorn Ext Cab 4WD | $168 | $300 | $386 | $22 | $116 | $992 | $83 |

| Dakota ST Ext Cab 4WD | $168 | $300 | $386 | $22 | $116 | $992 | $83 |

| Dakota Laramie Crew Cab 2WD | $168 | $354 | $484 | $28 | $144 | $1,178 | $98 |

| Dakota ST Crew Cab 4WD | $168 | $300 | $386 | $22 | $116 | $992 | $83 |

| Dakota Lonestar Ext Cab 4WD | $168 | $300 | $386 | $22 | $116 | $992 | $83 |

| Dakota Bighorn Crew Cab 4WD | $168 | $300 | $386 | $22 | $116 | $992 | $83 |

| Dakota TRX Crew Cab 4WD | $168 | $354 | $386 | $22 | $116 | $1,046 | $87 |

| Dakota TRX Crew Cab 4WD | $168 | $354 | $386 | $22 | $116 | $1,046 | $87 |

| Dakota Lonestar Crew Cab 4WD | $168 | $354 | $386 | $22 | $116 | $1,046 | $87 |

| Dakota Laramie Crew Cab 4WD | $188 | $354 | $386 | $22 | $116 | $1,066 | $89 |

| Get Your Own Custom Quote Go | |||||||

Cost estimates assume single male driver age 40, no speeding tickets, no at-fault accidents, $1000 deductibles, and Oregon minimum liability limits. Discounts applied include multi-vehicle, safe-driver, homeowner, multi-policy, and claim-free. Rate information does not factor in vehicle garaging location which can decrease or increase prices noticeably.

Cost comparison with and without full coverage

The diagram below illustrates the difference between Dodge Dakota insurance rates with full physical damage coverage compared to only buying liability only. The premium estimates are based on no accidents, no driving violations, $1,000 deductibles, single marital status, and no discounts are factored in.

When to drop comprehensive and collision coverage

There is no exact formula for dropping full coverage, but there is a general guideline you can use. If the yearly cost for physical damage coverage is more than about 10% of replacement cost minus your deductible, then you might want to consider buying only liability coverage.

For example, let’s assume your Dodge Dakota book value is $6,000 and you have $1,000 full coverage deductibles. If your vehicle is totaled in an accident, the most your company would pay you is $5,000 after the policy deductible has been paid. If you are currently paying more than $500 annually to have full coverage, then it might be time to buy liability only.

There are some conditions where dropping physical damage coverage is not advised. If you still owe money on your vehicle, you have to maintain full coverage in order to prevent your loan from defaulting. Also, if your savings is not enough to buy a different vehicle in the even your car is totaled, you should not opt for liability only.

Discount Portland car insurance rates

Insuring your vehicles can cost a lot, but you may qualify for discounts that can drop the cost substantially. Some trigger automatically at the time of quoting, but some must be inquired about prior to receiving the credit.

- Drive Safe and Save – Drivers who avoid accidents could pay up to 40% less than drivers with accident claims.

- Policy Bundle Discount – When you combine your auto and home insurance with the same insurance company you may earn over 10 percent off each policy depending on the company.

- Anti-theft System – Vehicles that have factory alarm systems and tracking devices can help prevent theft and will qualify for a discount on a Portland car insurance quote.

- Driver’s Ed – Teen drivers should enroll and complete driver’s education in high school.

- Seat Belts Save – Drivers who require all occupants to buckle up before driving can save a little off the PIP or medical payment premium.

- ABS Braking Discount – Vehicles with ABS braking systems or traction control can avoid accidents and the ABS can save up to 10%.

- Early Signing – A few insurance companies offer discounts for renewing your policy prior to your current Dakota insurance policy expiration. Ten percent is about the average savings.

Just know that most discounts do not apply to the whole policy. Most only cut specific coverage prices like comprehensive or collision. So when the math indicates it’s possible to get free car insurance, nobody gets a free ride. Any qualifying discounts should help reduce the amount you have to pay.

The illustration below shows the comparison of Dodge Dakota insurance costs with and without discounts applied to the policy premium. The data is based on a female driver, a clean driving record, no claims, Oregon state minimum liability limits, comp and collision included, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-policy, multi-car, claim-free, safe-driver, homeowner, and marriage discounts applied.

Larger car insurance companies and a partial list of their discounts are included below.

- AAA includes discounts for pay-in-full, education and occupation, anti-theft, AAA membership discount, good driver, and multi-policy.

- Progressive has savings for online quote discount, online signing, multi-vehicle, continuous coverage, good student, homeowner, and multi-policy.

- State Farm may offer discounts for good student, Steer Clear safe driver discount, multiple autos, accident-free, and anti-theft.

- Esurance offers discounts including anti-lock brakes, online shopper, Switch & Save, safety device, anti-theft, and DriveSense.

- Nationwide policyholders can earn discounts including Farm Bureau membership, good student, business or organization, anti-theft, defensive driving, accident-free, and easy pay.

If you want low cost Portland car insurance quotes, ask every insurance company which discounts you qualify for. Depending on the company, some discounts may not apply to policyholders in Portland. For a list of providers that offer many of these discounts in Oregon, click this link.

Car insurance agents can help

Certain consumers still prefer to sit down with an agent and there is nothing wrong with that. Experienced insurance agents are trained to spot inefficiencies and help file insurance claims. An additional benefit of comparing insurance online is that you can find cheaper car insurance rates and still have a local agent. And buying from neighborhood agents is still important in Portland.

To find an agent, once you fill out this short form, your insurance data is transmitted to participating agents in Portland who will give you quotes for your insurance coverage. You won’t even need to leave your computer since rate quotes are delivered directly to you. If you have a need to get a comparison quote from a particular provider, you just need to visit that company’s website and submit a quote form there.

To find an agent, once you fill out this short form, your insurance data is transmitted to participating agents in Portland who will give you quotes for your insurance coverage. You won’t even need to leave your computer since rate quotes are delivered directly to you. If you have a need to get a comparison quote from a particular provider, you just need to visit that company’s website and submit a quote form there.

Below is a list of insurers in Portland that may be willing to give rate quotes for Dodge Dakota insurance in Portland.

Elliott, Powell, Baden and Baker Inc

1521 SW Salmon St – Portland, OR 97205 – (503) 227-1771 – View Map

Stamm Stuart Bybee Insurance

16455 SE Division St – Portland, OR 97236 – (971) 254-1148 – View Map

Kilong Ung – State Farm Insurance Agent

4000 SE 82nd Ave #1400 – Portland, OR 97266 – (503) 777-6762 – View Map

Darrell Grenz Insurance Agency

5651 N Lombard St – Portland, OR 97203 – (503) 206-6736 – View Map

Selecting an provider needs to be determined by more than just the bottom line cost. These questions are important to ask:

- How much training do they have in personal risk management?

- Do you have coverage for a rental car if your vehicle is in the repair shop?

- Can you choose the body shop in case repairs are needed?

- Does the agency have a positive business rating?

- Is insurance their full-time profession?

More quotes mean more car insurance savings

We covered many ways to reduce Dodge Dakota insurance prices online in Portland. The most important thing to understand is the more providers you compare, the better chance you’ll have of finding the cheapest Dodge Dakota rate quotes. Consumers could even find that the best price on car insurance is with some of the smallest insurance companies. They may have significantly lower rates on certain market segments than the large multi-state companies such as Progressive and GEICO.

When buying insurance coverage, it’s not a good idea to skimp on critical coverages to save a buck or two. In too many instances, someone sacrificed collision coverage to discover at claim time that it was a big error on their part. Your goal is to buy enough coverage at the best possible price, but do not sacrifice coverage to save money.

To read more, link through to the resources below:

- Comprehensive Coverage (Liberty Mutual)

- Who Has Affordable Portland Car Insurance for Drivers with Good Credit? (FAQ)

- What Car Insurance is Cheapest for a Ford F-150 in Portland? (FAQ)

- Who Has the Cheapest Auto Insurance Rates for Low Mileage Drivers in Portland? (FAQ)

- Air Bags: Potential Dangers to Your Children (Insurance Information Institute)

- How to Avoid Staged Accidents (State Farm)

- What if I Can’t Find Coverage? (Insurance Information Institute)