It’s an obvious statement that insurance companies want to keep your business as long as possible. Consumers who shop around for a cheaper policy are inclined to buy a different policy because the odds are good of finding a more affordable policy. A recent survey found that people who compared prices once a year saved approximately $865 annually as compared to drivers who didn’t regularly shop around.

It’s an obvious statement that insurance companies want to keep your business as long as possible. Consumers who shop around for a cheaper policy are inclined to buy a different policy because the odds are good of finding a more affordable policy. A recent survey found that people who compared prices once a year saved approximately $865 annually as compared to drivers who didn’t regularly shop around.

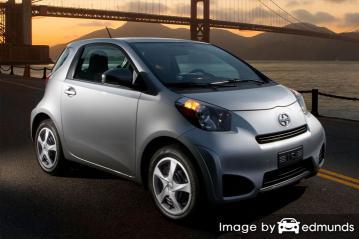

If finding the cheapest price for Scion iQ insurance in Portland is your ultimate objective, understanding how to quote prices and compare auto insurance can save time and money.

The best way we recommend to find low-cost Scion iQ insurance is to start comparing prices yearly from insurance carriers who sell insurance in Portland.

- Learn about what coverages are included in your policy and the things you can change to prevent expensive coverage. Many things that result in higher rates like careless driving and an unfavorable credit rating can be improved by improving your driving habits or financial responsibility.

- Get rate quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only give prices from one company like Progressive and State Farm, while independent agents can provide price quotes from many different companies.

- Compare the price quotes to the premium of your current policy to determine if you can save on iQ insurance in Portland. If you can save money and decide to switch, ensure there is no coverage lapse between policies.

- Tell your current company of your intent to cancel your existing policy and submit any necessary down payment along with the completed application for your new coverage. Once the paperwork is finalized, safely store the certificate verifying proof of insurance somewhere easily accessible.

A key point to remember is that you’ll want to make sure you compare identical limits and deductibles on each quote request and and to get rates from as many companies as feasibly possible. This guarantees an accurate price comparison and a complete price analysis.

Auto insurance providers offering low-cost rate quotes in Oregon

The providers in the list below have been selected to offer price quotes in Portland, OR. In order to find cheap auto insurance in Portland, we recommend you get rate quotes from several of them in order to find the most affordable rates.

Auto insurance policy discounts you can’t miss

Car insurance companies don’t always list all available discounts in a way that’s easy to find, so we break down some of the more common in addition to some of the lesser obvious credits available to you.

- Discounts for Safe Drivers – Drivers who don’t get into accidents can save up to 40% or more on their Portland car insurance quote than their less cautious counterparts.

- Payment Method – If you can afford to pay the entire bill rather than spreading payments over time you may reduce your total bill.

- Multiple Cars – Insuring all your vehicles on one policy qualifies for this discount.

- Discounts for Seat Belt Usage – Buckling up and requiring all passengers to fasten their seat belts may be able to save a few bucks off the medical payments premium.

- Employee of Federal Government – Active or retired federal employment can save as much as 8% depending on your company.

It’s important to note that many deductions do not apply to all coverage premiums. Most only apply to specific coverage prices like physical damage coverage or medical payments. Despite the appearance that all the discounts add up to a free policy, you aren’t that lucky.

A partial list of companies that possibly offer these money-saving discounts include:

If you need lower rates, check with all companies you are considering which discounts you qualify for. Some discounts might not be offered in Portland.

Learn How to Get Car Insurance for Less

Many things are part of the equation when quoting car insurance. Some are obvious such as your driving record, although some other factors are less apparent like where you live or your commute time.

The itemized list below are some of the most common factors that factor into your prices.

Teenage drivers pay more – Older insureds are shown to be more cautious, are lower risk to insure, and are safer drivers. Youthful drivers tend to be inattentive when behind the wheel so they pay higher car insurance rates.

Extra coverages can waste money – There are a lot of extra bells and whistles that you can buy if you aren’t careful. Add-on coverages like rental car reimbursement, death and dismemberment, and additional equipment coverage are examples of these. They may sound like good ideas at first, but if you’ve never needed them in the past consider taking them off your policy.

Alarms and GPS tracking lower prices – Selecting a car model with a theft deterrent system can get you a discount on your car insurance. Theft deterrent systems like tamper alarm systems, vehicle immobilizer technology and General Motors OnStar all help prevent your car from being stolen.

Don’t cut corners with liability insurance – Liability coverage will afford coverage if you are responsible for an accident. Your liability coverage provides legal defense up to the limits shown on your policy. Liability insurance is pretty cheap compared to other policy coverages, so insureds should have plenty of protection for their assets.

Premiums go up with performance – The type of vehicle you own makes a big difference in your car insurance bill. Smaller low performance passenger cars generally receive the lowest base rates, but the final cost of insurance is determined by many other factors.

Insurance loss data for Scion iQ vehicles – Insurance companies analyze past claim statistics when they calculate premium costs for each model. Vehicles that are shown to have higher losses will have higher rates. The table below illustrates the loss history for Scion iQ vehicles.

For each coverage type, the loss probability for all vehicles, regardless of make, model or trim level, equals 100. Percentages below 100 suggest a positive loss record, while values that are 100 or greater indicate more frequent claims or larger claims.

| Vehicle Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Scion iQ | 77 | 81 | 75 |

Empty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Comparing rates from local Portland car insurance agents

A lot of people prefer to visit with an insurance agent and that is not a bad decision A good thing about price shopping on the web is you can get cheap auto insurance quotes and still choose a local agent. And supporting local agencies is important especially in Portland.

For easy comparison, once you complete this form (opens in new window), your information is instantly submitted to companies in Portland who can give free rate quotes to get your business. There is no need to search for an agent since rate quotes are delivered immediately to you. You can get cheaper auto insurance rates without a big time investment. If you wish to get a rate quote from a particular provider, don’t hesitate to navigate to their website and fill out their quote form.

If you prefer to buy auto insurance from a reliable insurance agent, it’s important to understand the types of insurance agents and how they differ in how they quote coverages. Agents in Portland can be described as either exclusive or independent agents depending on their company appointments.

Independent Agents

Agents that choose to be independent do not write with just one company and that allows them to write policies through lots of different companies and get the cheapest rates. To transfer your coverage to a different company, the business is moved internally without you having to go to a different agency. When shopping rates, we recommend you include rate quotes from at least one independent agent to have the best price comparison.

Listed below are independent agencies in Portland that may be able to provide free auto insurance quotes.

Fox Insurance Agency

1819 SW 5th Ave – Portland, OR 97201 – (503) 277-2300 – View Map

Vern Fonk

9955 SE Washington St #103 – Portland, OR 97216 – (971) 213-1015 – View Map

Matthew K Barnett Agency

3332 N Lombard St – Portland, OR 97217 – (503) 285-2546 – View Map

Exclusive Insurance Agents

Agents that choose to be exclusive can only quote rates from one company such as Allstate, State Farm and Farmers Insurance. These agents are unable to give you multiple price quotes so always compare other rates. Exclusive agents receive extensive training on sales techniques which helps offset the inability to provide other markets.

The following is a short list of exclusive agencies in Portland that are able to give price quote information.

Lidia Mazun – State Farm Insurance Agent

11916 SE Division St – Portland, OR 97266 – (503) 761-1444 – View Map

John Lokting – State Farm Insurance Agent

307 SE 102nd Ave – Portland, OR 97216 – (503) 252-5581 – View Map

Lisa Parks – State Farm Insurance Agent

11116 NE Halsey St A – Portland, OR 97220 – (503) 256-3077 – View Map

Selecting an car insurance agent should depend on more than just a cheap quote. The following questions are important to ask.

- What insurance company do they write the most business with?

- Will one accident increase rates?

- How often do they review policy coverages?

- Are they actively involved in the community?

- How is replacement cost determined on your vehicle?

- Which insurance companies are they affiliated with?

- Who is covered by the car insurance policy?

What is the best car insurance company in Oregon?

Picking a highly-rated auto insurance provider can be a challenge considering how many companies sell coverage in Portland. The company rank data shown below can help you select which auto insurance companies to look at purchasing coverage from.

Top 10 Portland Car Insurance Companies by A.M. Best Rank

- USAA – A++

- Travelers – A++

- GEICO – A++

- State Farm – A++

- The Hartford – A+

- Esurance – A+

- Nationwide – A+

- Allstate – A+

- Mercury Insurance – A+

- Titan Insurance – A+

Cheaper insurance is a realistic goal

Cost effective Scion iQ insurance can be found from both online companies and from local insurance agents, and you should be comparing both in order to have the best price selection to choose from. Some insurance providers may not offer rates over the internet and many times these small insurance companies prefer to sell through independent insurance agencies.

When you buy Portland car insurance online, it’s a bad idea to reduce coverage to reduce premium. There have been many cases where someone dropped physical damage coverage only to find out that it was a big mistake. Your strategy should be to buy enough coverage at a price you can afford while not skimping on critical coverages.

To read more, feel free to browse the resources below:

- Drunk Driving Statistics (Insurance Information Institute)

- Who Has the Cheapest Auto Insurance for Government Employees in Portland? (FAQ)

- Who Has Affordable Portland Auto Insurance Rates for a 20 Year Old Female? (FAQ)

- Who Has the Cheapest Auto Insurance Quotes for a Jeep Wrangler in Portland? (FAQ)

- Where can I buy Insurance? (Insurance Information Institute)

- Property Damage Coverage (Liberty Mutual)