The recommended way to find affordable quotes for Nissan Leaf insurance is to start doing a yearly price comparison from insurance carriers that insure vehicles in Portland. Drivers can shop around by following these steps.

The recommended way to find affordable quotes for Nissan Leaf insurance is to start doing a yearly price comparison from insurance carriers that insure vehicles in Portland. Drivers can shop around by following these steps.

Step 1: It will benefit you to learn about what is in your policy and the factors you can control to prevent expensive coverage. Many rating criteria that are responsible for high rates such as traffic violations and an imperfect credit score can be amended by improving your driving habits or financial responsibility. Keep reading for more information to get lower rates and find discounts that you may qualify for.

Step 2: Compare price quotes from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can only give prices from a single company like Progressive or Farmers Insurance, while independent agencies can provide prices from many different companies. View a list of agents

Step 3: Compare the quotes to your current policy premium to determine if you can save on Leaf insurance. If you find a better price and change companies, make sure coverage does not lapse between policies.

Step 4: Give proper notification to your current agent or company to cancel your current coverage and submit a completed policy application and payment for your new coverage. Don’t forget to place the new certificate of insurance in your vehicle’s glove compartment or console.

The most important part of shopping around is that you’ll want to compare the same deductibles and limits on every quote request and and to get price quotes from as many auto insurance providers as possible. Doing this enables an apples-to-apples comparison and the best price quote selection.

It’s an obvious conclusion that auto insurance companies want to keep you from shopping around. People who shop around for cheaper prices will probably switch companies because there are good odds of finding a policy with more affordable rates. A survey found that consumers who shopped around every year saved about $3,500 over four years compared to people who didn’t regularly shop around.

If finding discount rates on auto insurance in Portland is your objective, then learning a little about the best ways to shop for insurance rates can save time and make the process easier.

If you have a policy now or want to find a cheaper company, you can use these tips to reduce the price you pay while maximizing coverage. Our objective is to teach you a little about how to get online quotes and also pocket some savings Drivers only need an understanding of the most efficient way to compare rates online.

The companies shown below can provide price comparisons in Portland, OR. To get the best auto insurance in Portland, OR, it’s a good idea that you click on several of them to get the best price comparison.

Get lower-cost Nissan Leaf insurance in Portland with discounts

Some companies don’t always advertise their entire list of discounts in an easy-to-find place, so the list below contains a few of the more well known and the more hidden discounts that may be available.

- Discount for Good Grades – This discount could provide a savings of up to 20% or more. Most companies allow this discount up until you turn 25.

- Senior Citizen Discount – Seniors may receive a discount up to 10%.

- Memberships – Being in a qualifying organization could trigger savings on your next renewal.

- Low Mileage Discounts – Maintaining low annual mileage may enable drivers to earn substantially lower prices.

- Early Payment Discounts – If you pay your entire premium ahead of time rather than paying monthly you can actually save on your bill.

- Save with More Vehicles Insured – Insuring multiple vehicles on one policy can reduce rates for all insured vehicles.

- Anti-lock Brakes – Cars that have steering control and anti-lock brakes are much safer to drive and will save you 10% or more on Leaf insurance in Portland.

- Seat Belts Save – Buckling up and requiring all passengers to wear their seat belts could save 15% off the medical payments premium.

You should keep in mind that most discount credits are not given to your bottom line cost. Most cut individual premiums such as comp or med pay. So even though it sounds like you would end up receiving a 100% discount, companies wouldn’t make money that way.

Insurance companies that may have most of the discounts above include:

Before you buy a policy, ask every company which discounts you qualify for. Some credits might not apply everywhere. If you would like to view insurers who offer free Nissan Leaf insurance quotes in Oregon, click this link.

What Determines Nissan Leaf Insurance Premiums?

When buying insurance it’s important to understand the different types of things that help determine your premiums. When you know what positively or negatively determines base rates, this allows you to make educated decisions that may result in big savings.

- Insurance companies don’t like frequent insurance claims – Companies in Oregon generally give better rates to drivers who file claims infrequently. If you file claims often, you can look forward to either policy cancellation or increased premiums. Insurance coverage is intended to be relied upon for major claims that would cause financial hardship.

- Rates and vocation – Jobs such as lawyers, architects, and emergency personnel are shown to have the highest average rates attributed to job stress and long work days. Other careers such as professors, students and retirees generally pay rates lower than average.

- Insure your auto and home with one company – Lots of insurance companies will give discounts to customers who buy several policies from them in the form of a multi-policy discount. Discounts can add up to as much as ten percent or more If you currently are using one company, it’s still a good idea to compare Nissan Leaf rates in Portland to help ensure you have the lowest rates.

- Higher coverage deductibles are cheaper – Comp and collision deductibles are the amount of money the insured will be required to pay if a claim is determined to be covered. Insurance for physical damage to your car, also called comprehensive and collision insurance, protects your car from damage. Some examples of covered claims would be collision with another vehicle, animal collisions, and damage caused by road hazards. The more expense you are required to pay out-of-pocket, the lower your rates will be.

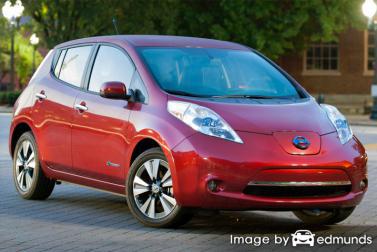

- What type of car do you drive? – The type of car you are insuring makes a huge difference in how high your rates are. The lowest premiums are usually found on lower performance four cylinder passenger cars, but the cost you end up paying is determined by many additional factors.

-

Nissan Leaf insurance claim data – Insurance companies analyze the history of losses to calculate a price that offsets possible losses. Vehicles that the statistics show to have increased losses will have a higher premium rate. The table below outlines the compiled insurance loss statistics for Nissan Leaf vehicles.

For each coverage type, the statistical loss for all vehicles, regardless of make or model, equals 100. Percentage numbers below 100 mean the vehicle has better than average losses, while values that are above 100 point to more claims or statistically larger claims.

Insurance Loss Ratings for Nissan Leaf Vehicles Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan Leaf Electric 89 84 45 83 64 76 BETTERAVERAGEWORSEData Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Local agents and auto insurance

A small number of people prefer to get professional advice from a licensed agent and there is nothing wrong with that. Professional insurance agents can help you build your policy and help submit paperwork. An additional benefit of comparing rates online is the fact that drivers can get cheap auto insurance quotes but still work with a licensed agent.

By using this form (opens in new window), your insurance data is emailed to companies in Portland that give free quotes for your business. There is no need to contact any agents because prices are sent to you instantly. If you have a need to compare prices from a specific auto insurance provider, you just need to find their quoting web page and submit a quote form there.

Picking an insurer requires more thought than just the premium amount. These are some questions your agent should answer.

- Do they regularly work with personal auto policies in Portland?

- How much training do they have in personal risk management?

- Does the agency support the community they serve?

- Are they giving you every discount you deserve?

- Which company do they place the most coverage with?

- Is the agency covered by Errors and Omissions coverage?

Do I need special coverages?

When it comes to adequate coverage for your personal vehicles, there is no cookie cutter policy. Your situation is unique and your car insurance should be unique as well.

For example, these questions may help highlight if your situation may require specific advice.

- Does my car insurance cover rental cars?

- Why do I need rental car insurance?

- Is my business laptop covered if it gets stolen from my vehicle?

- Which companies will insure high-risk drivers?

- Should I drop comprehensive coverage on older vehicles?

- Are split liability limits better than a combined single limit?

- What are the best liability limits?

- Which companies are cheaper for teen drivers?

- What policy terms are available?

If it’s difficult to answer those questions then you might want to talk to an insurance agent. To find lower rates from a local agent, complete this form or go to this page to view a list of companies. It’s fast, doesn’t cost anything and may give you better protection.

One last thing about your coverage

Some insurance providers don’t offer online price quotes and many times these smaller companies provide coverage only through local independent agencies. Affordable Nissan Leaf insurance in Portland is possible on the web as well as from insurance agents, so you should be comparing quotes from both so you have a total pricing picture.

As you shop your coverage around, it’s a bad idea to skimp on coverage in order to save money. There are a lot of situations where an insured cut liability coverage limits only to find out that it was a big mistake. Your aim should be to get the best coverage possible for the lowest cost but still have enough coverage for asset protection.

Additional detailed information can be read in these articles:

- Side airbags reduce rollover fatalities (Insurance Institute for Highway Safety)

- What Car Insurance is Cheapest for Ride Shares in Portland? (FAQ)

- Who Has Affordable Portland Auto Insurance Rates for Hybrid Vehicles? (FAQ)

- Protect Yourself Against Auto Theft (Insurance Information Institute)

- What is Full Coverage? (Allstate)

- Determining Auto Insurance Rates (GEICO)